Resident booted from HOA board due to language of living trust

Q: I placed my condo in a living trust for estate purposes. I am the beneficiary of the trust and I can amend, add and remove administrators. However, I am not the trustee of my trust.

I was a board member of our homeowners association (HOA). The manager of our HOA said I was required to resign from the board, I could not serve on committees, and I could not speak at meetings. The manager’s reasoning was I was not the legal person that could represent the trust and sit on the board and do other things that a homeowner could do at board meetings.

I searched online and found some information on my own. One piece of information from the association’s attorney’s website states that in a trust, the beneficiary has the status of an owner. When I raised this issue to our board president, they mentioned I needed to be the trustee to be considered the homeowner.

The roles in my trust agreement are as beneficiary and administrator, neither of which, for example, are included in the form we use to vote for board members. The attorney who drew up the living trust agreement disagrees with our HOA law firm. What do you think?

A: Words mean different things to different people, even in a legal context. You’ve raised some interesting points. We have written many columns recommending that our readers put their assets into living trusts to avoid probate expenses when they die and to minimize the challenges survivors might have in transferring title to assets. But, we haven’t addressed how that might impact them in the here and now.

Generally, living trusts consist of a beneficiary and a trustee. Most often, the beneficiary and the trustee are the same person. For example, you might have a home and other assets that you want to put into your living trust. You find an estate attorney to draw up the papers, set up the trust and then convey ownership interest in the assets into the trust.

Once that is done, the trust is the legal owner of the assets. The beneficiary of the trust owns a beneficial interest in all of the assets, while the trustee gets to direct what is done with the trust assets. We won’t go into complicated trust arrangements that are used for tax planning purposes, charitable gifts, generation skipping trusts and the like.

The basic principle of the most commonly used living trust is to have the beneficiary and the trustee be the same person. In this scenario, the HOA won’t care about any trust issues, as everything points to the same person.

Let’s say you had rented your home. You would be the owner and the tenant would be living in the home. The tenant wouldn’t have the right to sit on the board or act as the owner. Only the landlord would have that right.

The way your trust is set up, you are the beneficiary of the trust, but the trust agreement likely states that all decisions of the trust are made by the trustee. If that’s the case, the HOA sees you more as a tenant and not as the owner.

You mentioned you are the administrator and not a trustee. Does your trust have a trustee? Does that trustee have all of the rights to handle the affairs of the trust? Or did your estate attorney create a complicated arrangement that separated some of the duties that would ordinarily be handled by the trustee to be handled by you as the administrator? You’d need to see what that means in the context of the situation with your HOA.

You mentioned your estate attorney disagrees with the board president. Your attorney might be right, but you’ll need to have your attorney provide the board president with some documentation to prove you are authorized to act on behalf of the trust and take actions on behalf of the trust. We think your HOA wants reassurance to know that you have the complete authority to represent the trust — they don’t believe you do.

Talk to your estate attorney to get the HOA the information they deem necessary to allow you to hold office and act on behalf of the trust. And, hopefully, that will allow you to be as fully engaged with the board.

========

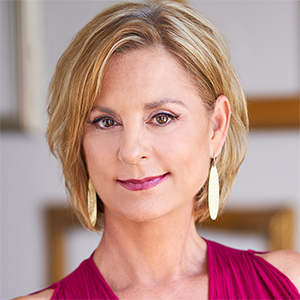

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask (4th Edition).” She writes the Love, Money + Real Estate Newsletter, available at Glink.Substack.com. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments