Paramount sues Warner Bros. Discovery over its deal with Netflix

Published in Entertainment News

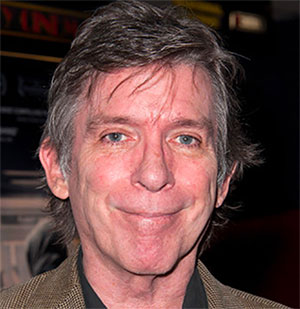

David Ellison's Paramount has sued Warner Bros. Discovery — the smaller firm's latest move to block Warner's $72 billion sale to Netflix.

The lawsuit, filed Monday morning in Delaware court, asks Warner and its chief executive David Zaslav to produce more information about Warner's deliberations and decision to select Netflix, ending the hotly contested auction on Dec. 4.

Last week, Warner's board unanimously rejected Paramount's $30-a-share proposal that included a personal guarantee by Ellison's father, the tech billionaire Larry Ellison, to cover the equity portion of Paramount's deal. Paramount is waging a hostile takeover, asking Warner investors to sell their shares to Paramount.

Paramount Skydance's lawsuit contends that Warner's board breached its disclosure duties "by failing to provide full, accurate, and truthful information" to investors. Paramount, however, stopped short of asking the court to block the Netflix deal.

Instead, Paramount said it was simply seeking access to information to allow shareholders to evaluate the competing offers — Paramount's or Netflix's — "while reserving the right to seek further relief as appropriate."

Separately, David Ellison said Paramount was preparing a proxy fight and would nominate its own slate to serve as Warner's board.

The move came the morning after the Golden Globes ceremony in Beverly Hills, in which Zaslav's warm relations with Ted Sarandos, Netflix's co-chief executive, were on display. Both Warner Bros. Discovery and Netflix had a strong night at the award show, which was televised by Paramount's CBS network.

Paramount has asked for an expedited hearing.

In its lawsuit, Paramount accused Warner board members of misleading shareholders and concealing its financial analysis on how much Warner's basic cable channels, including CNN, HGTV, Food Network and TNT, are worth.

Netflix's $27.75 a share offer does not include Warner's cable channels. Netflix is only interested in HBO, HBO Max streaming service and the venerable Warner Bros. television and movie studios.

In contrast, Paramount's $78-billion offer is to take over all of Warner, including the TV channels. Warner last summer announced plans to spin off its cable channels into a new company, Discovery Global. Its investors will get stock in the new company.

However, the new shares have not been priced and Paramount has argued they won't be worth much. "We have analyzed [the Discovery Global channels] as having zero equity value," Ellison wrote to shareholders. That makes Paramount's $30 a share offer higher, Paramount argues.

A Warner Bros. representative did not provide immediate comment. Netflix declined to comment.

Neither Netflix nor Paramount has raised its bid since the submitted formal proposals on Dec. 4. Paramount, in its lawsuit, alleged that Warner board members acted hastily, approving Netflix's deal — its total enterprise value would be $82.7-billion — even though Paramount told Zaslav and Warner's top banker on Dec. 4 that it hadn't submitted its " 'best and final' offer."

Paramount has submitted eight proposals to Warner since Sept. 14.

In a Monday letter to shareholders, David Ellison wrote that Warner has "provided increasingly novel reasons for avoiding a transaction with Paramount."

"Paramount started this process about four months ago with a private offer at a significant premium to WBD's $12.54 share price, and our pursuit culminated in the $30 per share all-cash, fully financed proposal we made before WBD entered into the Netflix transaction," Ellison wrote.

"We are committed to seeing our tender offer through," Ellison said. "We understand, however, that unless the WBD board of directors decides to exercise its right to engage with us under the Netflix merger agreement ... this will likely come down to your vote at a shareholder meeting."

Paramount has set a Jan. 21 deadline for Warner investors to tender their shares, although that deadline could be extended.

©2026 Los Angeles Times. Visit at latimes.com. Distributed by Tribune Content Agency, LLC.

Comments