Terry Savage: Are home buying opportunities returning?

There is never a good time to buy a home — except in hindsight. As first-time home buyers try to make the leap, the prices and interest rates seem daunting. Prices their parents paid 40 years ago seem like bargains now, and they despair of ever being able to afford their dream house.

Take heart. History shows the best time to buy a home is when things look gloomy — not when it’s easy. But courage takes some perspective. And the latest statistics show some weakness in the housing market.

The most recent headline is an unexpected 5.9% drop in housing starts in May, and a sharp decline in building permit applications, as homebuilders become increasingly cautious amid a slowdown in consumer demand. New housing starts are now at a five-year low. But in all this bad news I’m smelling opportunity!

The median sale price for existing homes in the U.S. is around $438,466, showing a 1.4% increase year-over-year, according to Redfin. Shockingly, in 2000 the median home price was $119,000!

Then again, the median household income was $42,148 in 2000, compared to $75,000 today. Based on averages and medians, housing has been a good investment over the long run.

In home buying, as in most big financial decisions, timing is everything. It was only a few years ago that it seemed home prices were destined to skyrocket every year, with frequent bidding wars.

But the latest Redfin survey shows that just over 28% of U.S. homes are selling above the asking price, down from 32% a year earlier. That’s the lowest level for this time of year since 2020.

The annual spring selling season has turned into somewhat of a disappointment for real estate agents. Pending U.S. home sales fell 1.1% year over year to their lowest level for this time of year in Redfin records. And the median sale prices showed a 7% discount from the median listing price.

When there’s an overabundance of homes for sale, buyers have the edge. And recently, despite a widespread shortage of housing stock, the number of listings has been creeping up. The number of newly listed homes is now up 8.5% year-over-year according to Redfin.

Home prices nationwide were up 0.8% year-over-year in May. Yet for the same period, the number of homes sold fell 6.0% and the number of homes for sale rose 14.1%.

Home builders are worried, too. According to the National Association of Homebuilders, builder confidence fell sharply in May and again in June on growing uncertainties stemming from elevated interest rates, tariff concerns, building material cost uncertainty and the cloudy economic outlook.

That lack of builder confidence is impacting prices. The latest HMI survey also revealed that 37% of builders cut home prices in June, up from 34% in May, the highest percentage since NAHB started tracking that monthly statistic in 2022.

It doesn’t take an economist to see that the housing market is softening — both the resale market for existing homes, and the confidence of home builders. While these signs point to an opportunity for potential home buyers, one thing is standing in the way.

In recent months, as prices have leveled off, affordability has inched up. But the NAHB reports that 76.4 million households — 57% out of a total of 134.3 million — are unable to afford a $300,000 home. That’s based on the assumption that the cost of a mortgage, property taxes and property insurance should not exceed 28% of household income.

Bottom line: Buying that first home is often a real stretch, requiring a two-income household that has saved up for at least a 10% down payment. Before you give up, Redfin also reports that young home buyers are twice as likely to use family money for a down payment as they were five years ago. The huge intergenerational transfer of wealth from baby boomers has already started.

This is the easiest concern to overcome when buying a home. Yes, higher rates mean larger monthly payments and thus lower affordability. Mortgage rates have been stuck around the 7% level for several years. But the key to mortgage rates is simple: You can always refinance if rates go down. If rates go up, you’ll consider yourself lucky at 7%!

All of the above could change quickly, so you’d best be prepared. Yes, home prices could rise because of tariffs and shortages on building materials. But it’s equally likely that tariffs could trigger a recession, and a sharp decline in home sales. That in turn could — as it has in the past — trigger a housing slowdown that gives new buyers an opportunity to enter the marketplace at more reasonable prices.

A good credit report, some savings for a down payment, and a willingness to take the leap could allow you to look back 20 years from now with a smile — just like those who purchased in the housing crash of 2009-2011. And that’s The Savage Truth.

========

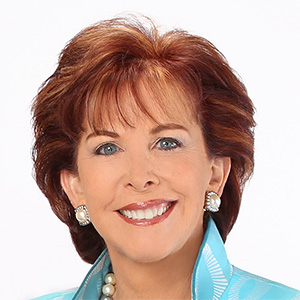

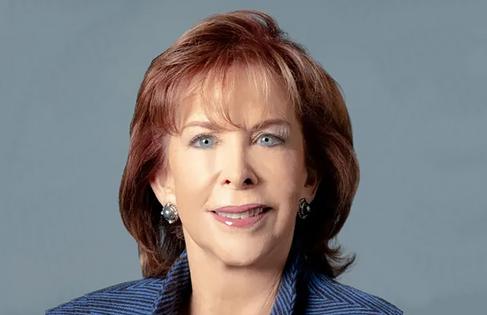

(Terry Savage is a registered investment adviser and the author of four best-selling books, including “The Savage Truth on Money.” Terry responds to questions on her blog at TerrySavage.com.)

©2025 Terry Savage. Distributed by Tribune Content Agency, LLC.

Comments