Jill On Money: How to choose a financial advisor

“When do I need to hire a financial advisor?” An advisor or planner is like a financial navigator, someone who helps you articulate where you would like to go on your financial journey and provides various routes to get you there... kind of like Waze for your financial life.

Anyone you engage in such an important relationship must be held to the fiduciary standard, a duty that requires that the person providing advice or guidance acts in your best interest, even if doing so is not in their own or their company’s best interest.

To ensure that you are working with one, seek out those who hold one of these designations: CFP® certification, CPA Personal Financial Specialist, Chartered Financial Analyst, and members of the National Association of Personal Financial Advisors.

Before you start, here are three questions to consider:

You can hold off on engaging an advisor until you pay down your consumer and student loan debt; have accumulated an emergency reserve fund of six to 12 months of living expenses; and have maxed out your retirement plan (aka “Jills Big 3”). As a side note, these to-dos require that you understand how much you spend — and unfortunately, only you can do this dreaded task.

If you have the time, energy, know-how and emotional discipline to do so, managing your own financial life and creating, updating and executing your plan can be rewarding. As a bonus, the price is right!

But sometimes you need financial advice because you’re your own worst enemy and the process can cause stress. According to the CFP Board of Standards’ 10-year Financial Planning Longitudinal Study (FPLS24), people using financial professionals tend to have lower levels of general and financial anxiety.

In most relationships, there is a division of labor, which often leaves one person responsible for “money stuff.” If that’s you, establishing a relationship with a financial planner before something bad happens can help the surviving spouse better manage the rest of the journey.

If you determine that you are ready to proceed, here are three more questions to ask a potential financial professional during the interview process (after you confirm that they person is a fiduciary!):

Financial planners typically charge in one of three ways: fee-only (hourly or flat fee), fee-based (percentage of your assets under management), or commission-based. While commissions are not inherently bad, an advisor who receives them has incentives that might not always align with yours.

If someone is going to manage your money, you need to understand their approach to investing. Most will highlight long-term, diversified strategies, but ask what investments they use to do so.

Are they believers in passive or low-cost index or exchange-traded funds or do they think active managers are preferable? (Note: I am a big believer in the former!) Be wary of those who say they can beat the market or suggest complicated products.

Working with a financial planner is an intimate relationship that will hopefully last a long time, so make sure you're comfortable with this person. Ask about the frequency of communication, and also, who will be the primary contact about service issues.

Ultimately, you want expertise, trustworthiness, and someone who listens to your concerns. Also, while most advisors have a broad-based clientele, make sure that they have experience working with people whose situations are similar to yours.

_____

_____

========

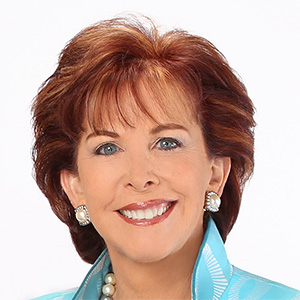

(Jill Schlesinger, CFP, is a CBS News business analyst. A former options trader and CIO of an investment advisory firm, she welcomes comments and questions at askjill@jillonmoney.com. Check her website at www.jillonmoney.com)

©2025 Tribune Content Agency, LLC

Comments