Moody's boosts Atlantic City to investment grade a decade after its near bankruptcy

Published in Business News

ATLANTIC CITY — A decade after teetering on the edge of bankruptcy and being taken over by the State of New Jersey, Atlantic City has been given an investment-grade rating by Moody’s Ratings.

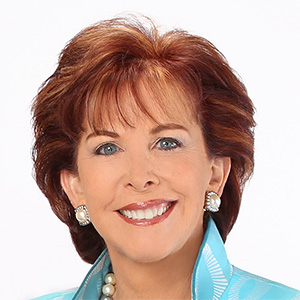

“Today is a tremendous day to start the new year,” Atlantic City Mayor Marty Small Sr. said Monday at a livestreamed news briefing. “The city of Atlantic City is officially investment grade.”

The credit rating of Baa3 puts the city in the lowest long-term investment-grade category, several steps from the top A ratings. But it marks a dramatic rise from 10 years ago, Small noted, when he was sworn in as the City Council president.

“We had the junkiest junk bonds imaginable,” he recalled. “The city’s finances were not in a good state. Employees were getting paid once a month. People were running to the bank to cash their checks. The outlook was bleak. We even entertained that we were bankrupt. It was a long, drawn-out fight. However, that was then; this is now.”

Small himself ended 2025 in dramatic fashion: a two-week trial that ended in an acquittal on charges that he physically abused his teenage daughter.

Small and business administrator Anthony Swan said at the Dec. 31 meetings that Moody’s expressed interest in seeing a stable government and experienced department directors.

Small was sworn in to a new four-year term on New Year’s Day with his daughter in attendance and said then that the family has begun the healing process. A decision is expected soon by the Atlantic County prosecutor on whether to pursue similar charges against his wife, La’Quetta Small, the city’s schools superintendent.

The state’s takeover of Atlantic City expired Dec. 1. But another bill is moving through the legislature that will leave the state in charge of Atlantic City finances for another six years. It calls for a “master developer” to oversee major projects, even as the city is trying to regain control over planning and zoning.

There are other challenges ahead for Atlantic City: New York City approved three casino licenses that could cut a substantial hole in Atlantic City’s gambling revenue and prompt state lawmakers to approve casinos in North Jersey. Casino owners also oppose an effort to ban smoking in the city’s casinos that is now before an appellate court.

Though the state takeover began a decade ago in hostile fashion, it evolved to a cooperative partnership. Small praised the decision by incoming Gov. Mikie Sherrill to keep Jacquelyn Suárez as head of the state’s Department of Community Affairs, which would oversee the next takeover.

But Monday was a day of triumph for the city.

Small noted that the city had substantially reduced its debt to $228 million, down from a peak of $550 million, and cut taxes six years in a row. Of that, only $71 million is debt directly incurred by the city; the rest are legacy debts from money owed to casinos from tax appeals. He anticipated announcing a seventh tax cut in the coming weeks.

“This government gets criticized all the time,” he said. “People say, ‘Oh they’re spinning like drunken sailors, spinning spinning spinning like it’s out of control.’ Ladies and gentlemen, that’s just not true.”

Business administrator Swan said Moody’s was interested in more than just numbers. “It’s about the stability of the city,” he said. “It’s about how the city is run.”

Finance director Toro Aboderin called the announcement “an extraordinary milestone.” She said Moody’s asked about “bulkheads, roads, infrastructure.”

“Restoring Atlantic City to sound financial footing has been our top priority every single day,” she said. “A lot of people talk about Atlantic City and how we’re terrible, how the finances are the worst, and the roads are messy. They say all kinds of things, but we have attained something quite remarkable.”

Officials hope the vote of confidence from Moody’s will signal to investors and developers to look again at their city, which has some of the most affordable beachfront real estate on the East Coast.

An investment-grade credit rating signals to financial markets that Atlantic City is a lower-risk borrower, although the mayor emphasized that the city currently has no need to borrow.

©2026 The Philadelphia Inquirer, LLC. Visit at inquirer.com. Distributed by Tribune Content Agency, LLC.

Comments